How To Create A Multifamily Real Estate Investment Strategy

By homz | March 18, 2025

The real estate industry provides a wide variety of investment possibilities; multifamily housing stands out for its capacity to provide consistent income, long-term appreciation, and risk diversification. Building a solid real estate investment plan for multifamily buildings will assist you in attaining your financial objectives with confidence, whether you are a seasoned investor or just starting.

This book will assist you in developing a robust strategy from the foundation up. You will grasp the principles of multifamily housing, receive important investment property advice, and learn how to create a sustainable real estate portfolio that expands with time.

Let’s get started.

Understanding The Basics Of Multifamily Housing

Multifamily housing is residential homes with more than one housing unit, such as duplexes, triplexes, and apartment complexes. These properties let you manage one asset while earning rental money from several renters.

Scalability is one of the key benefits. A single multifamily property with ten apartments can provide the same profit potential, often with less hassle than owning and managing ten single-family houses.

Furthermore, multifamily buildings often have less vacancy risk. Should one apartment be vacant, the other units nonetheless provide income, offering superior cash flow stability over single-family homes.

Building a wise property investment guide starts with knowledge of these fundamentals.

Set Definite Investment Objectives

Before diving into any property, spend some time clarifying your investment goals. Do you want tax benefits, long-term equity growth, or monthly cash flow? Or do you wish to one day move to full-time investing?

Establishing objectives guarantees that your real estate investment plan fits your risk tolerance and financial vision and helps to focus your property search. At the same time, a long-term investor might seek value-add possibilities in stable areas, and a short-term investor might give priority to high-yield assets in developing markets.

Whatever your objectives, make them SMART—Specific, Measurable, Achievable, Relevant, and Time-bound—to monitor your development efficiently.

Do Comprehensive Market Research

Knowing where to invest start of a good investment. Concentrate on areas with good job growth, rising population, infrastructural expansion, and proximity to services, including public transportation, hospitals, and schools.

Investigate future business projects, occupancy rates, typical rents, and property demand patterns. These elements help to forecast whether a market will stagnate or provide great rewards.

Using technologies, including census data, real estate analytics systems, and local economic statistics, can help you gain an edge over rivals. Avoiding underperforming properties and making sure your investment property suggestions are supported by facts depend on this action.

Create A Sustainable Real Estate Portfolio

Sustainability is now a need, not only a trend. Including sustainable real estate techniques into your investment plan not only helps the environment but also increases the long-term worth of your property.

Search for green certifications, water-saving fixtures, and energy-efficient appliances. Sustainable elements usually draw eco-conscious renters ready to spend more for a better, more responsible living space.

Governments could also provide rebates or tax credits for environmentally friendly improvements. Over time, these advantages, taken together with reduced utility expenses, can greatly enhance your property’s ROI.

Manage Risk And Obtain Financing

Any real estate investment plan depends on financing. Consider other possibilities, including commercial real estate loans, FHA multifamily loans, or traditional loans. Examine loan terms, interest rates, and down payment criteria.

Hidden expenses—maintenance, insurance, property management, taxes, and unanticipated repairs—should also be considered. Include this in your financial forecasts to know your actual net income.

Always save an emergency reserve and prevent over-leveraging to reduce risk. Working with mortgage brokers or financial consultants can help you to guarantee good conditions as well.

Think About Expert Property Management

Managing a multifamily property can be complicated and time-consuming. Property management calls for continuous attention, from tenant screening to rent collection and upkeep. Every unit presents its unique difficulties; managing many tenants requires constant responsiveness.

An experienced property manager guarantees improved tenant retention, saves you time, and lessens stress. Property managers are specialists in managing lease contracts, local laws, inspections, and conflict resolution. By guaranteeing prompt maintenance, controlling vendor connections, and equitably enforcing lease conditions, they also help to increase tenant happiness.

Although it costs more, a good property manager usually pays for themselves by raising occupancy, guaranteeing prompt maintenance, reducing turnover, and preserving steady cash flow. Their knowledge of the area also aids in maintaining property compliance with changing housing legislation. Professional management is a wise strategic investment for long-term success.

Monitor Performance And Change Your Approach

A successful real estate investing plan is not set. Regular assessment and changes depending on market trends, property performance, and financial objectives define a successful real estate investment approach. To find areas of improvement, investors should be proactive and plan quarterly or bi-annual performance evaluations.

Monitor internal rate of return (IRR), cash-on-cash return, net operating income (NOI), and occupancy rate, among other important performance indicators (KPIs). These indicators provide an analysis of whether your property is fulfilling expectations or requires reconfiguration. By producing automated reports, property management software and data analytics technologies can help streamline this procedure.

Reevaluate operational efficiency, marketing plans, or rent price if a property underperforms. On the other hand, if your portfolio is strong, think about expanding into untapped areas or refinancing. Strategic choices, including rent optimization or improvements, can also raise returns. This approach guarantees that your property investment strategy stays in line with your long-term vision and keeps producing consistent returns.

Wrapping Up

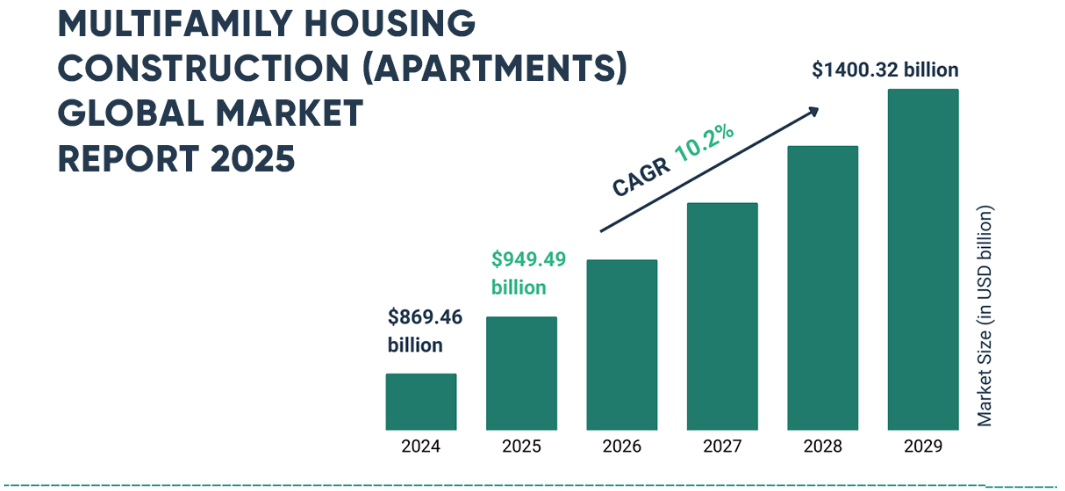

Multifamily housing provides a special mix of long-term stability, cash flow, and scalability. Investors can create a varied and successful real estate portfolio with the correct planning, market analysis, and emphasis.

Begin by knowing your objectives, conducting market research, and matching your investments with long-term trends in environmental responsibility and housing demand. Turning multifamily buildings into a strong wealth-building tool calls for using expert help and data-driven decision-making.

Homz Global provides thorough analysis, reliable tools, and strategic assistance for investors at all levels. Browse our professional articles and property listings and receive tailored advice on how to develop multifamily housing.

info@homzglobal.com

info@homzglobal.com